Currency futures and options are mainly a derivative product that large financial institutions use to either hedge exposure to financial investment exposure or speculate on fx price action. The difference between options futures forwards futures options and forward contracts belong to a group of financial securities known as derivatives.

Derivatives Definition Types Forwards Futures Options Swaps Etc

Derivatives Definition Types Forwards Futures Options Swaps Etc

This paper aims to examine effectiveness of currency hedging of forward contracts and options in international portfolio consisting of assets denominated in chinese yuan and indian rupee.

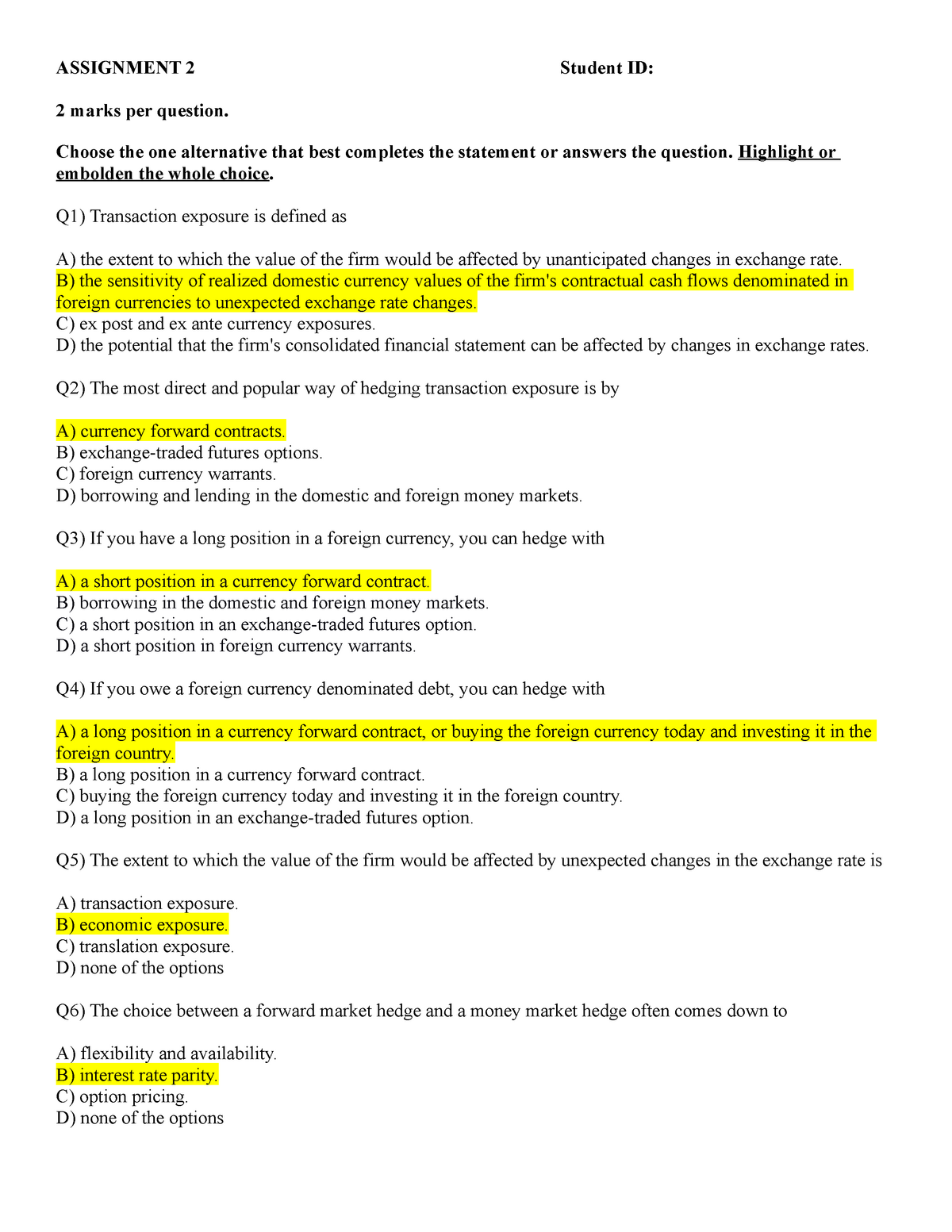

Foreign currency option vs forward contract. An fx forward is a perfect hedge for your foreign currency exposure val some future date. The options contract will specify which currency the option holder will submit and which she will receive as well as the quantities of each currency to submit and receive. A currency option is a contract that gives the buyer the right but not the obligation to buy or sell a certain currency at a specified exchange rate on or before a specified date.

Its profit and loss sides are equal. A forward extra is an alternative hedging contract that allows a business to buy foreign currency at a protection rate in the same way as a forward contract whilst also providing the opportunity to receive a rebate at the expiry date of the contra! ct. The profit or loss resulting from trading such securities ! is directly related to or derived from another asset such as a stock.

In addition the same flexibility exists that you would have with an open forward. Here are the main advantages and disadvantages of forward contracts and currency options compared to currency forwards. The current spot rate of the dollar against the yen is about 24350.

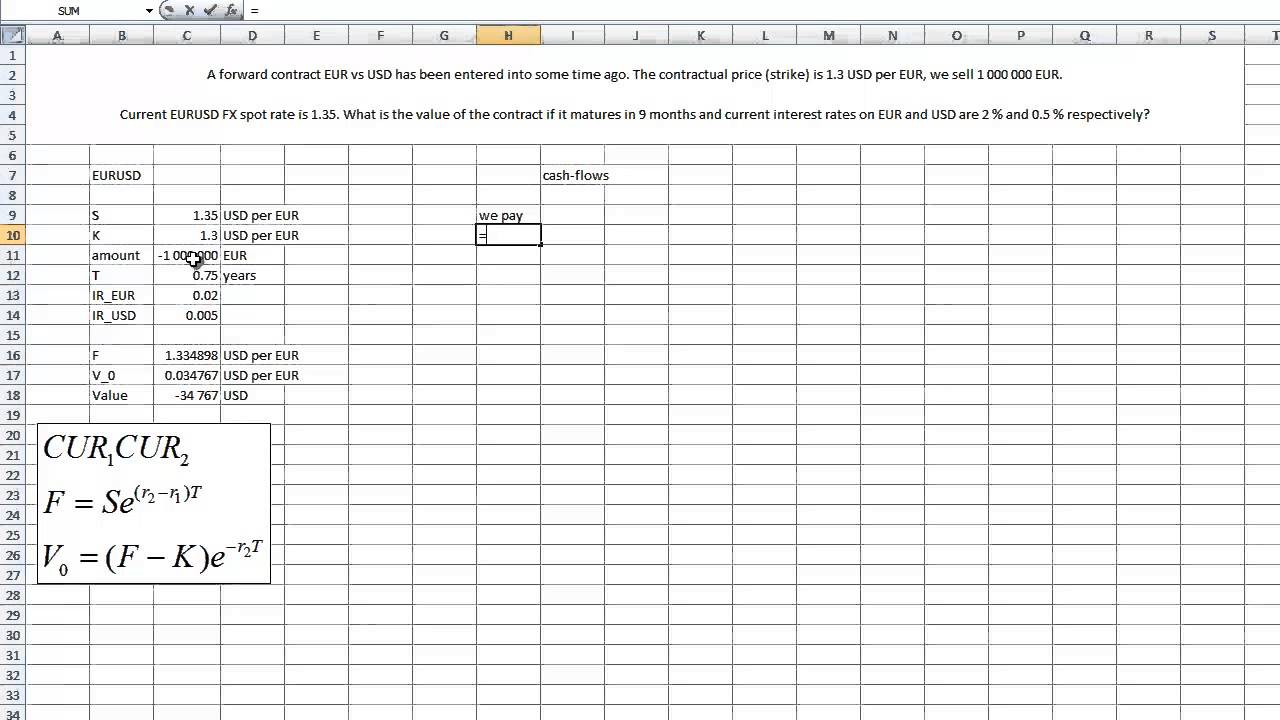

In foreign exchange markets a non deliverable forward contract is where you can buy and sell a currency at a fixed future date for a predetermined rate. An fx option can be used when you are not sure whether you will have that exposure and want to buy an insurance that will help you convert that foreign currency exposure when time comes. Following is an example of how using the forward market compares with using a currency option.

Currency options and futures are both derivative contracts they derive their values from the underlying asset in this case currency pairs. The opti! on may give the holder the ability to hand in 1000 euros and receive 1100 in return on feb. Below illustrates how to quote forward forward rates.

Fx Initiative Blog Cpe Page 2

Fx Initiative Blog Cpe Page 2

Forex Solutions For Importers Forwards And Options Business Banking

Forex Solutions For Importers Forwards And Options Business Banking

Fx Products

Fx Products

Normal Backwardation Wikipedia

Normal Backwardation Wikipedia

Foreign Exchange Markets Forward Exchange Contract Notes

Foreign Exchange Markets Forward Exchange Contract Notes

Forex Forward Contract Accounting

Forex Forward Contract Accounting

Most Exchange Traded Currency Options Exchange Traded Currency

Spot And Forward Contracts Versus Forex Options Youtube

Spot And Forward Contracts Versus Forex Options Youtube

Ppt Chapter 22 Forward And Futures Contract Powerpoint

Ppt Chapter 22 Forward And Futures Contract Powerpoint

Options Futures Swaps Forward Rate Agreements Recent Posts

Tutorial 7 Week 8 Solutions Fin3ifm International Financial

Tutorial 7 Week 8 Solutions Fin3ifm International Financial

Assignment 02 Questions Fin3ifm International Financial

Assignment 02 Questions Fin3ifm International Financial

The Currency Futu! res And Options Markets Ppt Download

The Currency Futu! res And Options Markets Ppt Download

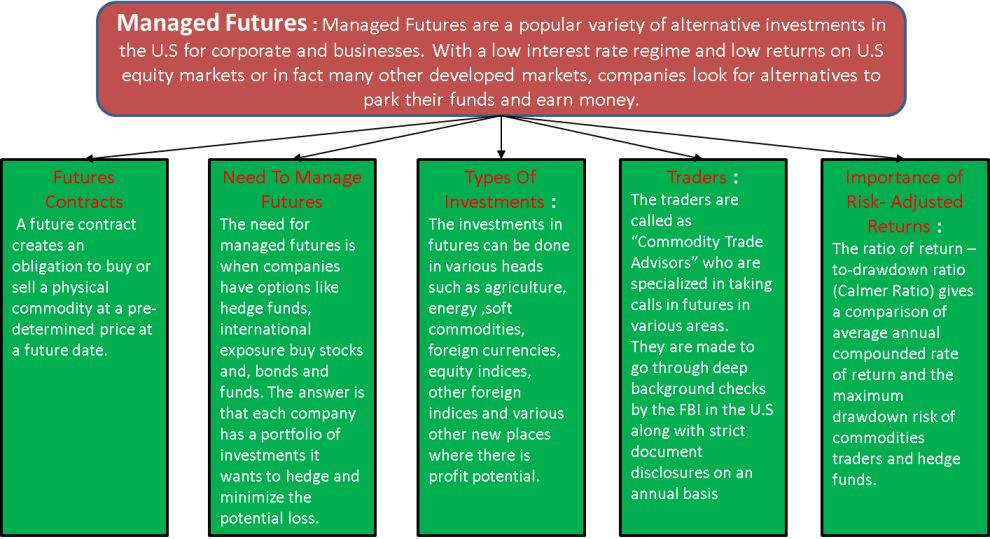

Why Firms Use Currency Derivatives